The Ultimate Help to Buy Guide will focus on the Help to Buy Equity Loan scheme. The other scheme, Help to Buy Mortgage Guarantee, will be the focus of another post.

Help to buy is a government scheme designed to help first-time buyers purchase their first home.

What Is Help to Buy?

The History

Help to buy was originally set up by the government in 2013 and was arranged to help people buy a home.

The government would provide you a loan to add to your deposit and mortgage.

You would receive a maximum loan of 20% of the property price. You would be expected to have 5% of the property as a deposit and the remaining 75% would be a mortgage.

If you purchase a property in London the maximum loan increases to 40% from 20%. You would still be required to put 5% deposit down, but the mortgage amount would be 55%.

In order to qualify for the scheme, you had to buy a new build property. You didn’t have to be a first-time buyer but you couldn’t own another property. The house you were buying had to be your main residence.

Now

Jump forward to 2021 and the core principle of the scheme hasn’t changed.

You still have the 20% loan outside London and 40% inside London, and it still has to be a new build property.

Sadly, now the scheme is solely for first time buyers. Anybody who has owned a property in the past can not benefit from the scheme.

Sorry to everyone that missed out!

The current scheme will end in March 2023.

Mortgages & Deposit

As mentioned before, you still need to have a mortgage with the scheme.

Outside of London that mortgage is 75% of the value of the property, inside London it’s 55%.

The lower the mortgage, the lower the monthly payments. Which means that you’re more likely to be able to afford the mortgage.

Example:

Imagine buying a property worth £300,000 without the Help to Buy scheme, and you put down a 5% deposit (£15,000) and take a 95% (£285,000) mortgage.

Using an interest rate of 2.50%, and a term of 30 years, your monthly payments would be £1,126.

Now, imagine buying the same property with Help to Buy. You would put a 5% (£15,000) deposit down, have a 20% (£60,000) government loan and a 75% (£225,000) mortgage.

Using an interest rate of 1.50%, and a term of 30 years, your monthly payments would be £777.

That’s a difference of £349 per month, which is huge.

You might notice that the interest rates were different in the two scenarios. This is because the lower the mortgage amount you take, often the lower the interest rate. Rates are at their highest with a 95% mortgage.

I’ve used the Straightforward Money mortgage payment calculator to work out the monthly payments. Click here and have a play around for yourself.

You also aren’t restricted to a 5% deposit. Should you wish to use a larger deposit you could reduce the total Help to Buy loan that you receive. For example, a 10% deposit would decrease the government loan to 15%. Alternatively, you could reduce the mortgage by 5% and keep the full 20% loan. The minimum is 5% deposit from you.

If you feel that the words used are a bit beyond your knowledge, please click here and read what a mortgage is.

The Loan Is Interest Free For 5 Years

Remember this is a loan, not a gift. We’d be so lucky!

As with any loan, you do have to pay it back, eventually.

You don’t have to pay anything back for the first 5 years, the loan is completely interest free during this period.

If you use the mortgage saving of £349 per month, over the 5 years you’ve saved £20,940.

If you pay the loan off during the first 5 years then you would not pay a penny in interest.

AMAZING!

You do pay a nominal £1 management fee per month from the start date to until the loan is repaid.

In the 6th year the interest payments will start.

The interest payment is 1.75% per year, which increases each year by CPI (Consumer Price Index) plus 2%.

Here’s what that looks like using our example above with an equity loan amount of £60,000, assuming CPI increase of 0.50% each year plus 2%:

Still cheaper than that 95% mortgage rate!

The Price Cap

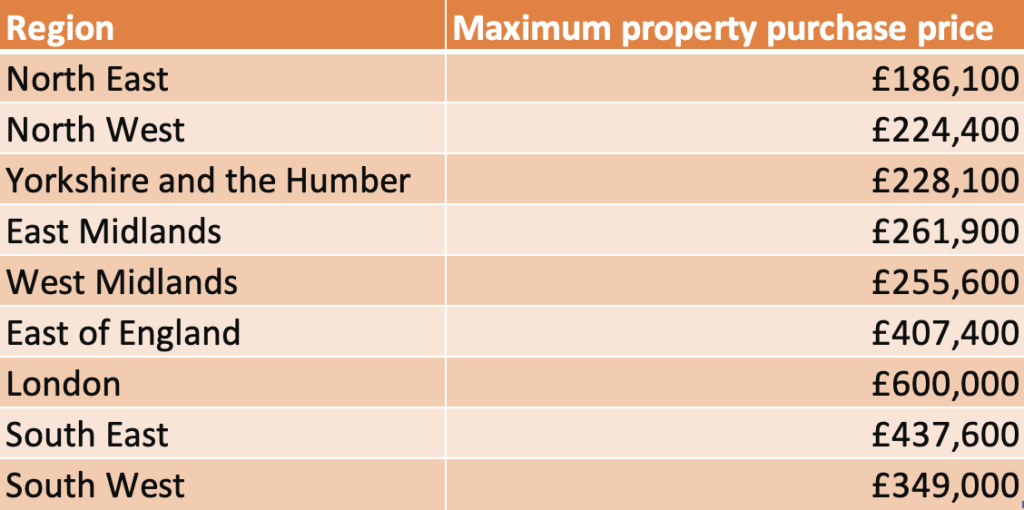

Along with having to be a first-time buyer and buying a new build property there is also a price cap on the value of the property you can buy, depending on your location:

So make sure you aren’t looking for properties above your areas price cap!

You Could Pay Back More Than You Borrow

The Help to Buy loan is based on the % of the purchase price. Taking a 20% loan of a £300,000 house means you have a loan of £60,000.

However, as the value of your property changes over the years so too will your loan.

The loan is 20% of the value at the time you pay it back.

So, if your property worth £300,000 increases to £350,000 in 5 years, then so too will the amount of loan you have to pay back. 20% of £350,000 is £70,000, meaning you would have to pay back £10,000 more than you borrowed.

On the flip side, the same is true if the price decreases. If it goes from £300,000 to £250,000 then you pay back 20% of £250,000 so £50,000, £10,000 less.

This will only affect you when you come to pay the loan back.

The positive for you

As your property price increases, so does the deposit that you put in initially.

Using the increase from £300,000 to £350,000, your initial deposit of £15,000 grows into £55,000, even when taking into account the increase in loan amount.

You will also be paying your mortgage off each month, which will increase your equity (money) in the property.

When do you repay the loan?

There are 3 conditions when you have to pay the full loan:

- You have a time limit; you must pay the full loan within 25 years.

- If you pay off your mortgage then you will also have to pay the full loan.

- If you sell your home, you must pay the full loan.

Other than these 3 circumstances you can continue to pay the interest payments each month until you’re forced to pay it off.

Paying off early

You can pay the loan off early if you want, and it’s usually a good idea before the yearly interest increases spiral out of control.

If your house has increased in value quite significantly then re-mortgaging is a great option.

You can pull out some of that deposit that has grown and use it to pay the loan off.

If you do this, I’d say it is best to retain at least 10% of the property value to ensure you get a good interest rate on your new mortgage.

The minimum you can repay on your loan is 10% of the value of your home. Which means you can pay the loan back over 2 payments.

Even paying back 10% of the loan when you reach year 5 will reduce the annual interest you have to pay, making it more affordable long term.

How To Apply

You will need to apply to Help to Buy directly, and who you apply to will depend on your location.

Use the below to apply:

North

Find out how to apply for an equity loan in the north.

Telephone: 0300 790 0570

Midlands and London

Find out how to apply for an equity loan in the Midlands and London.

Telephone: 0333 321 4044

South (excluding London)

Find out how to apply for an equity loan in the south.

Telephone: 0800 456 1188

Final points

When you apply for Help to Buy, they will do a calculation on the amount of loan that they are prepared to offer. This is similar to a mortgage affordability calculation. They need to ensure you can pay the interest payments after the 5 years.

The Help to Buy scheme is great for first time buyers trying to get on the property ladder. The extra 20% or 40% deposit goes a long way in increasing your affordability and reducing the monthly payments.

Just be careful of the 5-year time limit without interest payments, and start putting a plan together for what you want to happen after 5 years.

This could be re-mortgaging the property to pay off some or all of the loan. Or using savings and paying off 10% chunks at a time.

A plan is key!

Your home my be repossessed if you do not keep up your monthly payments on your mortgage.